Its one of the most sought-after bills of lading across many countries and is one of the most searched for and read articles on this blog.

What is a Switch Bill of Lading..

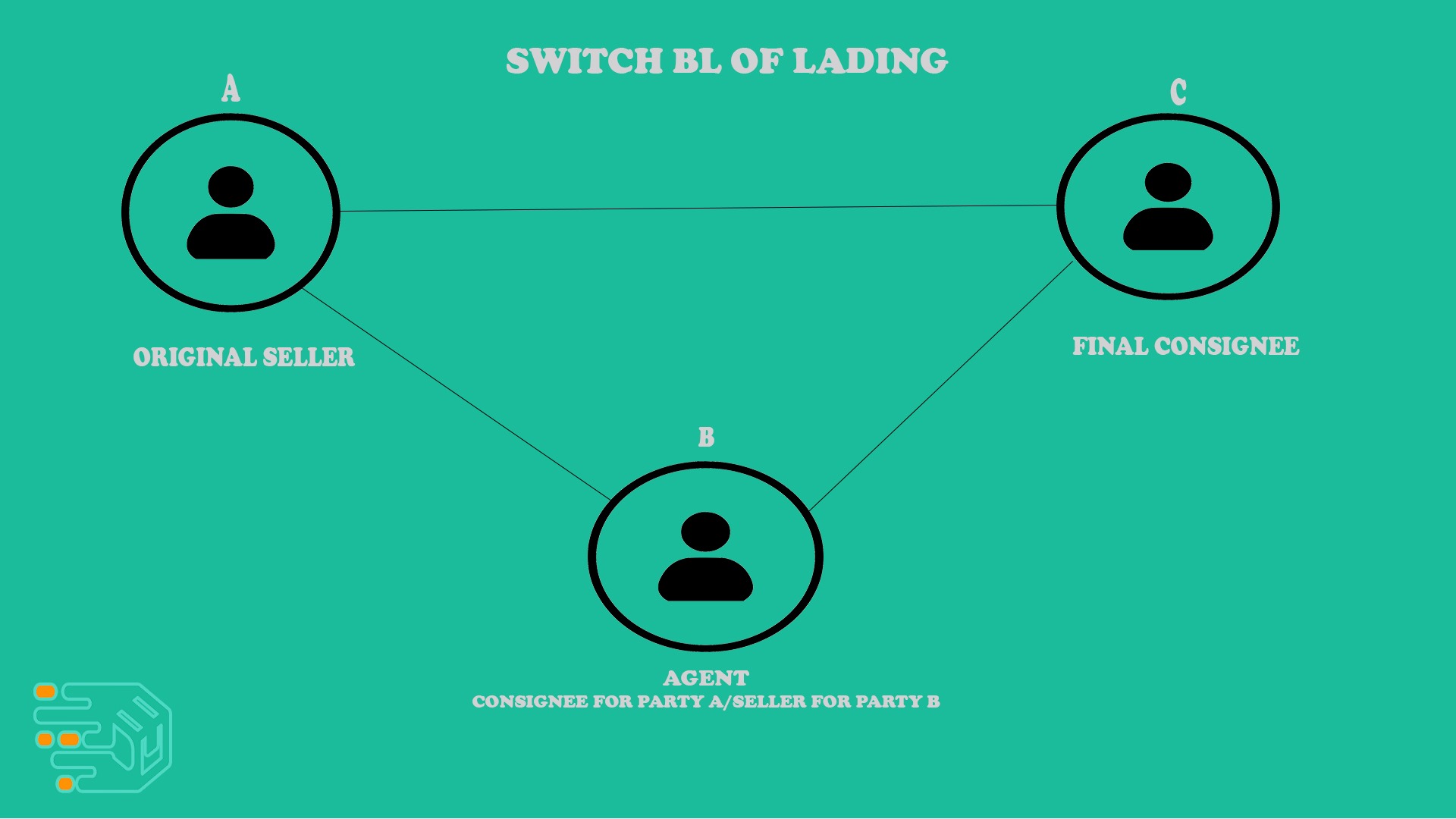

A “Switch” bill of lading is the second set of bill of lading that may be issued by the carrier (or agent) in exchange for the first set of bill of lading originally issued when the shipment was effected.

Why does one ask for or require a Switch bill of lading..??

Switch bills are requested generally when there has been a change in the original trading conditions. Some of the reasons could be :

- Goods could have been resold and the discharge port has now been changed to another port and this could have occurred as a high-seas sale.

- The seller (who could be an intending agent) does not wish the name of the actual exporter to be known to the consignee in case the consignee strikes a deal with the exporter directly.

- The seller does not want to know the buyer to know the actual country of origin of the cargo so he requests that the port of loading be shown as some port other than the one the cargo was loaded from.

Where can a bill of lading be switched..??

Depending on the shipping line and their coverage a bill of lading may be switched anywhere around the world for shipments from anywhere to anywhere.

For example on a shipment from New York to Antwerp, the bill of lading maybe switch in London as long as the shipping line in question has offices in London.

Is the issuance of Switch Bill of Lading legal..??

While there is nothing to say specifically that issuance of a switch bill of lading is illegal (unless there is willful intent to commit fraud), it seems to be the concerted view of almost all insurance companies, that a switch bill of lading issued with any misrepresentation or information contrary to the first set issued, without the express acceptance and understanding of the buyer is a fraudulent document..

In order to protect themselves from any possible claims arising out of issuing switch bills of lading, the shipping line/agent have to ensure that

- They are covered by their insurance for the issuance of such switch bills of lading

- They should provide their insurance company with the exact reason for the issuance of the switch bill of lading.

- They must have the written authority of the principal before issuing the switch bill of lading if the issuing party is acting as agents for a shipping line or principal..

- They must issue the switched bill only after collecting the first set of bills, as the dangers of two sets of original bills in circulation for the same cargo are many..

- The switched set should not contain any information different to that of the original bill of lading, (like an incorrect port of loading, or change in the condition and quantity of the cargo). If switch bills contain misrepresentations, the carrier/agent will be at risk of claims from parties who have suffered a loss because of such misrepresentations.

- If the agent has been asked by the principal to issue the switch bill of lading based on an indemnity from the customer, the agent should ensure to get the wording format from the principal and get the completed indemnity approved by the principal before issuing the switch bill of lading.

Switch Bills of Lading – Revisited – an article by NAU Pte Ltd., might shed some more light on the matter from a claims company perspective